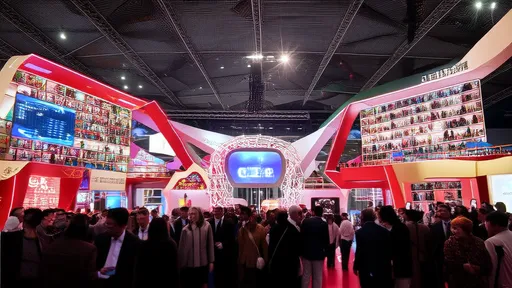

The grand hall of Beijing's Financial Street resonated with a renewed sense of global purpose as the 2025 Financial Street Forum Annual Conference drew to a close. Against a backdrop of complex geopolitical and economic crosscurrents, the three-day event transformed the Chinese capital into a dynamic global financial "living room," a neutral ground where the dominant theme was not competition, but the urgent necessity of collaboration.

The closing ceremony was not merely a procedural endpoint but a powerful summation of the consensus forged in countless meetings, panel discussions, and private exchanges. Senior officials, central bank governors, and chief executives from the world's leading financial institutions departed with a shared conviction: that the path to sustainable growth and stability is paved with open dialogue and mutual trust. The forum successfully served as a critical bridge, connecting diverse markets and philosophies under the common goal of navigating the uncertainties of the post-pandemic global economy.

A Confluence of Global Financial Leadership

The sheer concentration of financial intellect and influence at the forum was staggering. It was a veritable who's who of international finance. The keynote addresses were delivered by figures whose decisions move trillions of dollars in capital, and the panel discussions featured a diverse array of voices from Wall Street, the City of London, the Eurozone, and emerging financial hubs across Asia and Africa. This was not a monolithic gathering; it was a rich tapestry of perspectives, all converging on Beijing with a shared sense of responsibility.

One could observe the Governor of the People's Bank of China engaged in a deep, animated conversation with the Managing Director of the International Monetary Fund during a coffee break. In another corner, a European Central Bank executive board member was seen exchanging contact information with the CEO of a major African development bank. These unscripted moments, perhaps even more than the formal agenda, underscored the forum's value as a platform for building the personal relationships that underpin professional cooperation. The "living room" atmosphere facilitated a level of candor and informal problem-solving that is often missing in more rigid diplomatic or official settings.

The Unanimous Call for Open Markets and Collaborative Frameworks

Throughout the various sessions, a clear and consistent message emerged from speakers of all nationalities: the era of insularity and protectionism is a direct threat to global prosperity. There was a powerful, collective advocacy for keeping capital flows open, standardizing regulatory frameworks, and resisting the siren song of deglobalization. The discussions moved beyond abstract principles to tackle concrete, thorny issues.

Debates on the future of cross-border payments, for instance, focused on the potential of Central Bank Digital Currencies (CBDCs) to enhance efficiency while ensuring security and compliance. There was a palpable sense that the technology exists to revolutionize this space, but its success hinges on international cooperation to establish interoperability standards. Similarly, panels on sustainable finance grappled with the urgent need to harmonize the myriad of green taxonomies and ESG (Environmental, Social, and Governance) reporting standards that currently create confusion and "greenwashing" opportunities. The consensus was that without a coordinated global effort, the trillions of dollars required for a green transition would not flow efficiently to where they are needed most.

China's Role: A Stabilizing Force and Proponent of Inclusivity

The host nation's posture throughout the forum was closely watched, and the signals sent were unequivocal. Chinese financial leaders and policymakers used the platform to articulate a vision of China not as a disruptive force, but as a committed and responsible stakeholder in the global financial system. The narrative was one of steady opening-up, institutional improvement, and a desire to integrate more deeply with international norms.

Detailed presentations were made on the ongoing reforms in China's capital markets, aimed at enhancing transparency, attracting long-term foreign investment, and aligning with global best practices. There was a notable emphasis on "inclusive globalization," a concept that calls for ensuring the benefits of financial integration and technological advancement reach developing economies, thereby reducing global inequality. This stance resonated strongly with delegates from the Global South, who often feel sidelined in conversations dominated by established Western powers. China's advocacy for a more multipolar financial architecture, where their voices carry greater weight, was a significant undercurrent of the entire event.

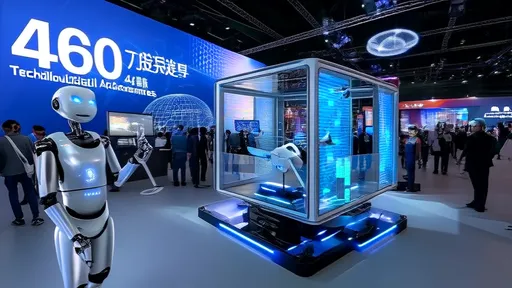

Technology and Innovation: The Double-Edged Sword

No financial forum in 2025 could ignore the transformative, and disruptive, power of technology. Artificial intelligence was a central topic, with panels dedicated to its application in risk management, fraud detection, and personalized financial services. The potential for AI to democratize access to sophisticated financial tools was celebrated. However, a strong note of caution was also sounded. Regulators and technologists alike warned of the systemic risks posed by AI-driven algorithmic trading, the ethical dilemmas of data usage, and the potential for new forms of cyber threats that could destabilize entire markets.

The discussion on fintech and digital assets was equally robust. While the innovation in blockchain and tokenization was acknowledged, there was a clear consensus on the need for a "same activity, same risk, same regulation" approach to prevent regulatory arbitrage and protect consumers. The forum served as a crucial meeting point for innovators and regulators, fostering a dialogue that is essential for ensuring that the breakneck speed of technological change does not outpace the frameworks designed to keep the system safe.

The Road from Beijing: From Dialogue to Concrete Action

As the final gavel fell, the question on everyone's mind was: what happens next? The true measure of the forum's success will not be the quality of the discussions in Beijing, but the tangible outcomes that follow. Several concrete initiatives were announced or gained significant momentum. A multilateral working group, comprising representatives from over a dozen major economies, was formally launched to draft a common set of principles for the governance of AI in finance.

Furthermore, a coalition of development banks and private financial institutions committed to a new action plan for funding climate-resilient infrastructure in vulnerable nations. Perhaps most symbolically, a pilot project for a cross-border CBDC platform involving several Asian central banks, including China's, was unveiled, marking a significant step towards the future of international settlements. These are not mere talking points; they are workstreams with deadlines and deliverables, providing a clear roadmap for collaboration in the months ahead.

The Echoes of a Shared Future

The 2025 Financial Street Forum has concluded, but its resonance will be felt for a long time. In an world often fragmented by tension and mistrust, it offered a powerful counter-narrative. It demonstrated that the global financial community retains the capacity for collective action. The "living room" in Beijing was a space where differences were acknowledged but not allowed to derail the pursuit of common interests. The strong, harmonious chord of open cooperation that concluded the event is more than just a hopeful sentiment; it is a strategic imperative. The challenges of climate change, technological disruption, and economic inequality are too vast for any single nation to tackle alone. The message from Beijing is clear: the future of finance, and by extension the global economy, must be written not in isolation, but through continuous, constructive, and open-ended dialogue.

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025